Five Myths About Living Trusts

When you are considering estate planning, you may ask family or friends for advice. But, there is a lot of misinformation circulating about estate planning, which is understandable given how complicated this area of law really is. In this article, we discuss five myths about living trusts and what you can do to ensure that your wishes are carried out and your loved ones are cared for, in the event of your incapacitation or death.

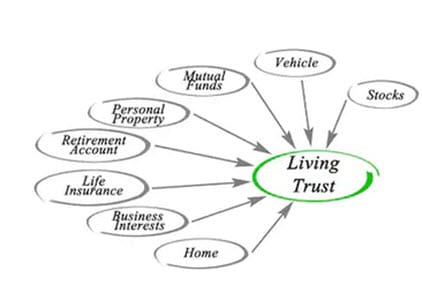

Living trusts, for example, are one of the most commonly misunderstood aspects of estate planning, but this should not stop you from creating one, if that is what is in your best interest. An experienced estate planning attorney can help you clear up any confusion you may have about estate planning, and help you get started on creating an ideal will and trust suited to meet your precise needs. According to the Registers of Wills, the following myths are some of the most commonly held among Marylanders.

MYTH #1: Living Trusts Reduce Taxes

While a “living” trust or revocable trust has many purposes, including avoiding probate and creating certain terms for using the money within the trust, they do not prevent inheritance tax or estate tax. There are other types of trusts that can be created to avoid or reduce estate tax, though only 0.1 percent of people fall into this tax bracket.

MYTH #2: Probate Should be Avoided at all Costs

Probate does take some time, and can incur costs of up to 10 to 15 percent of the estate’s value, probate is relatively straightforward in Maryland. In many cases, probate costs less than $1,000. For an estate worth $750,000, the probate fee is only $750. In fact, for small estates (valued at $50,000 or less [or $100,000 or less if the spouse is the sole legatee or heir], Maryland has an even faster, less expensive process.

MYTH #3: Only a Living Trust Can be Used to Avoid Guardianship

While a living trust can be created to make financial decisions for an incapacitated person, so too can a durable power of attorney. In fact, a power of attorney may be a better option for avoiding financial decision making guardianship. Furthermore, if you become incapacitated, you will most likely require a guardianship that takes on the medical and day to day living decision making as well. A living trust cannot, of course, accomplish this.

MYTH #4: Living Trusts Can be Used to Avoid Creditors

When the grantor of a trust is still alive, the assets within a revocable trust are the property of the grantor. As such, these assets can be pursued by creditors just as if their money was in a bank account or written into a will. A revocable trust cannot legally shield your assets from creditors, only an irrevocable trust can accomplish that.

MYTH #5: Living Trusts Ensure Privacy

While it may be possible to keep the trust document from becoming a matter of public record, here in Maryland it is required to file a schedule of the trust assets with the Register of Wills, which is part of the public record. A revocable trust may offer more privacy than a will that passes through probate, or it might not.

Get Legal Guidance Today!

Estate planning should be done with the careful guidance of an experienced estate planning attorney. To schedule a private consultation or review the myths about living trusts, contact the Maryland estate planning attorneys at Frame & Frame today. We have been serving the legal needs of our community for over 70 years.

Download our Free Guide to Wills, Trusts & Probate!

https://frameandframe.com/five-common-estate-planning-mistakes/