Choosing A Fiduciary

Estate planning is a vital aspect of ensuring that your assets are distributed according to your wishes, your loved ones are taken care of, and your legacy is preserved. In this complex process, selecting the right fiduciary is perhaps one of the most critical decisions you’ll make. When creating a comprehensive estate plan, you will need to appoint people you trust to carry out certain fiduciary roles. This article helps you consider the duties as well as the capabilities for the people you choose. This information can also serve to prepare the people you designate, in carrying out their responsibilities effectively. Below is an overview of the fiduciary roles and the importance of choosing a fiduciary for estate planning, probate and guardianship matters.

What Is a Fiduciary?

In the context of estate planning, a fiduciary is a person or entity that is entrusted with the responsibility of managing and administering certain aspects of an individual’s estate. This role involves a high level of trust, as fiduciaries are obligated to act in the best interests of the person who created the estate plan, often referred to as the “grantor” or “settlor.” A fiduciary can be an individual or institution entrusted with managing your affairs, assets, and ensuring that your directives are followed.

A fiduciary assumes a position of trust and responsibility, obligated to act in your best interests and adhere to the instructions outlined in your estate plan. Common fiduciaries include executors, trustees, and guardians.

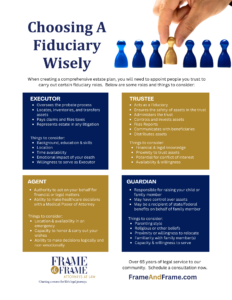

Executor or Personal Representative

Download the Free ChecklistThe executor is responsible for carrying out the terms of your will after your passing. In Maryland, the term Executor is often used interchangeably with the term Personal Representative. This person will be responsible for managing the probate process, ensuring debts are settled, and assets are distributed according to your wishes.

Since the probate process can take months or years, depending on the size of your estate, a probate attorney can be an invaluable guide to assist the Executor or Personal Representative. Choosing a reliable executor expedites the settlement of your estate, minimizing stress and complications for your beneficiaries.

In most cases, the Executor works side-by-side with your attorney to fulfill these duties. A probate attorney can also take care of time-consuming and complex processes such as locating assets, paying debts and taxes, and, lastly, distributing assets to beneficiaries.

A Trustee in Trust Administration

If your estate plan includes a trust or trusts, the trustee oversees the management and distribution of assets held in trust. They must adhere to the trust’s guidelines and act in the beneficiaries’ best interests, ensuring a seamless transition of assets.

While state laws and your trust dictate how assets should be distributed, it’s critical to have a reliable person that you have confidence will carry out these duties in accordance with the laws and with your wishes. Your estate planning attorney will also be available to assist with this process.

Guardian for Minor Children

If you have minor children, designating a guardian in your will is crucial for their well-being. A guardian assumes responsibility for the upbringing and care of your children, stepping in if both parents are unable to fulfill this role.

When choosing a guardian, you’ll want to consider the individual’s parenting style, belief systems, proximity, familiarity with family members and their capability or willingness to serve in such an important role in your children’s lives. A guardianship attorney can be helpful when making these decisions, and helping ensure your wishes are carried out.

The Importance of Choosing a Fiduciary

When choosing a fiduciary it is important to consider a variety of factors, depending on the role you are asking the individual to fulfill. Here is a brief list of qualities to consider when choosing a fiduciary for your comprehensive estate plan:

- Trust and Competence: Fiduciaries should be individuals or entities you trust implicitly. Competence is equally vital, as managing financial matters, legal obligations, and the well-being of loved ones requires a sound understanding of the responsibilities involved.

- Family Dynamics: Consider family dynamics and potential conflicts when selecting a fiduciary. Choosing an impartial and diplomatic executor or trustee can prevent disputes among beneficiaries.

- Legal Expertise: Estate laws and probate processes can be complex. Selecting a fiduciary who will consult with your legal professionals ensures that your estate is handled with precision, and in accordance with the laws.

- Long-Term Commitment: Fiduciary responsibilities often perform their roles over an extended period of time. Choose someone committed to fulfilling these duties diligently and over the necessary duration.

In estate planning, probate, and guardianship matters, the significance of choosing a fiduciary cannot be overstated. This decision shapes the effectiveness of your estate plan, impacting the financial well-being of your beneficiaries and the realization of your final wishes. Take the time to thoroughly evaluate potential fiduciaries and discuss the weight of this responsibility with them. By doing so, you can instill confidence that your legacy will be preserved and your loved ones well-cared for in the years to come.

Download the free checklist to Choosing a Fiduciary to start the conversations and ensure that you have the right people in place when you need them. If you need help with the estate planning process, contact us to schedule a consultation.