Do You Have a Family Member With Special Needs? Why You Need a Trust

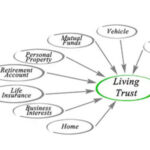

If you are the parents of a child with special needs, have siblings or other family members with special needs, you may be concerned about how to provide for their long term care and financial security. Many people write these loved ones into their wills, with the best of intentions, thinking they are acting in… Continued